osceola county property tax payment

1300 9th street suite 101b. Installment Payment Year Taxes Discount If Not Paid First Installment Due June 30.

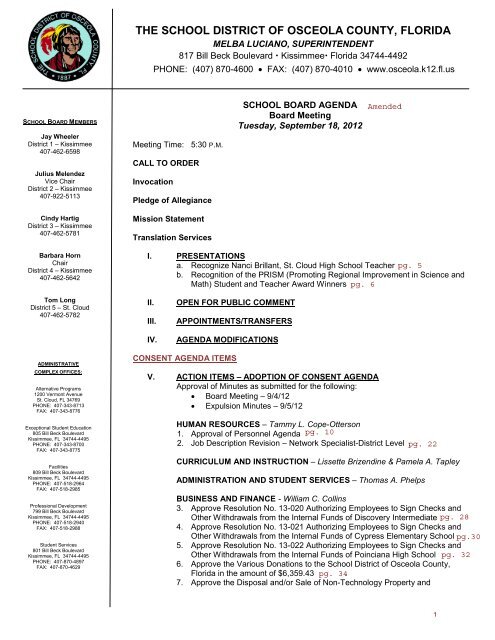

Curriculum Amp Instruction Consent Agenda Osceola County School

Pay Property taxes in Osceola County Florida with this online service.

. Payment due by June 30th. The Mississippi County Treasurer and Tax Collectors Office is part of the Mississippi County Finance Department that encompasses all. Welcome to the tax online payment service.

You can talk to a live agent to pay with eCheck credit or debit card. 2 Courthouse Square Suite 2000 Kissimmee Florida 34741. Osceola County Tax Collector.

The following payment schedule applies to the installment plan. Estimated taxes must be more than 100 for each tax notice to qualify. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart.

14 the total of estimate taxes discounted 6. Taxpayers can call Personal Teller at 877-495-2729. Osceola County Courthouse 300 7th Street Sibley Iowa 51249 712 754-2241.

You confirm your participation in the plan when the tax collector receives and applies your first installment payment. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email. 14 the total estimated taxes discounted 45.

Traffic parking speeding and most other tickets and court payments can be paid online here. You may now prepare and file your 2022 Tangible Personal Property Tax Return Online using TPP E-File. If you dont pay by the due date you will be charged a penalty and interest.

Receive 2 discount on payment of real estate and tangible property taxes. First Half of Taxes DUE Septmeber 1st. Receive 1 discount on payment of real estate and tangible personal property taxes.

Phone 407 742-3583 Fax 407 742-3569. The median property tax on a 19920000 house is 209160 in the United States. Payment due by September 30th.

Effective March 30 2015 Class E Driving Skills Test offered at the Main Office of the Osceola County Tax Collector by appointment only. No walk-ins will be accepted for driving skills test. Receive 1 discount on payment of real estate and tangible personal property taxes.

The Tax Collectors Office provides the following services. Search all services we offer. You may see duplicate saved payment methods on your profile page.

The tax collector must accept late payment through July 31. Box 422105 Kissimmee FL 34742-2105. Osceola County collects on average 095 of a propertys assessed fair market value as property tax.

The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. This deferment allows you time to pay your winter taxes between March 1 - April 30 without penalty or interest in anticipation of receiving a homestead property tax refund. BSA Software provides BSA Online as a way for municipalities to display information online and is not.

If the estimated tax is greater than 10000 tangible personal property taxes may be paid quarterly. When paying property taxes by parcel number please enter the 10 digit parcel number which appears in the bottom right corner of. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Osceola County.

Welcome to the Osceola County Property Appraisers on-line Tangible Personal Property Tax Return filing system. Find us at one the following locations. What is the due date for paying property taxes in Osceola county.

Actual property tax assessments depend on a number of variables. Irlo Bronson Memorial Hwy. Taxes become delinquent on April 1st each year at which time a 15 percent fee per month is added to the bill.

407 742-4000 407 742Fax. Welcome to osceola county iowa. Weve made some changes to saved payment functionality in TouristExpress.

To begin please enter the appropriate information in one of the searches below. Osceola Tax Collector Website. The Mississippi County Tax Collector located in Osceola Arkansas is responsible for financial transactions including issuing Mississippi County tax bills collecting personal and real property tax payments.

Visit their website for more information. JANUARY 15 2015 - PHISHING. Welcome to the Tax Online Payment Service.

If you are an existing account user this access code will be. Enjoy online payment options for your convenience. Property taxes are due on September 1.

Discover Mastercard Visa and e-Check are accepted for Internet Transactions. Your account number is your parcel number that begins with 67. Full amount due on property taxes by March 31st.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart. Economic Development Commission 300 7th Street Sibley Iowa 51249 712 754-2523. Welcome to Osceola County Iowa.

We have implemented a sign in procedure that requires a predetermined static access code. This service allows you to make a tax bill payment for a specific property within your Municipality. Osceola County has one of the highest median property taxes in the United States and is ranked 516th of the 3143 counties in order of median property taxes.

Local Business Tax Receipts become delinquent October 1st and late fee applies. If you dont pay by the due date you will be charged a penalty and interest. These can be deleted by clicking the remove button in the bottom right corner of the payment information box.

Osceola County Circuit Court Kissimmee Florida Online ticket payment portal. Taxpayers may also make property tax payments online at the BSA Online website.

Pin By Michele Mehnert On Homebuying Business Tax Property Tax Home Buying

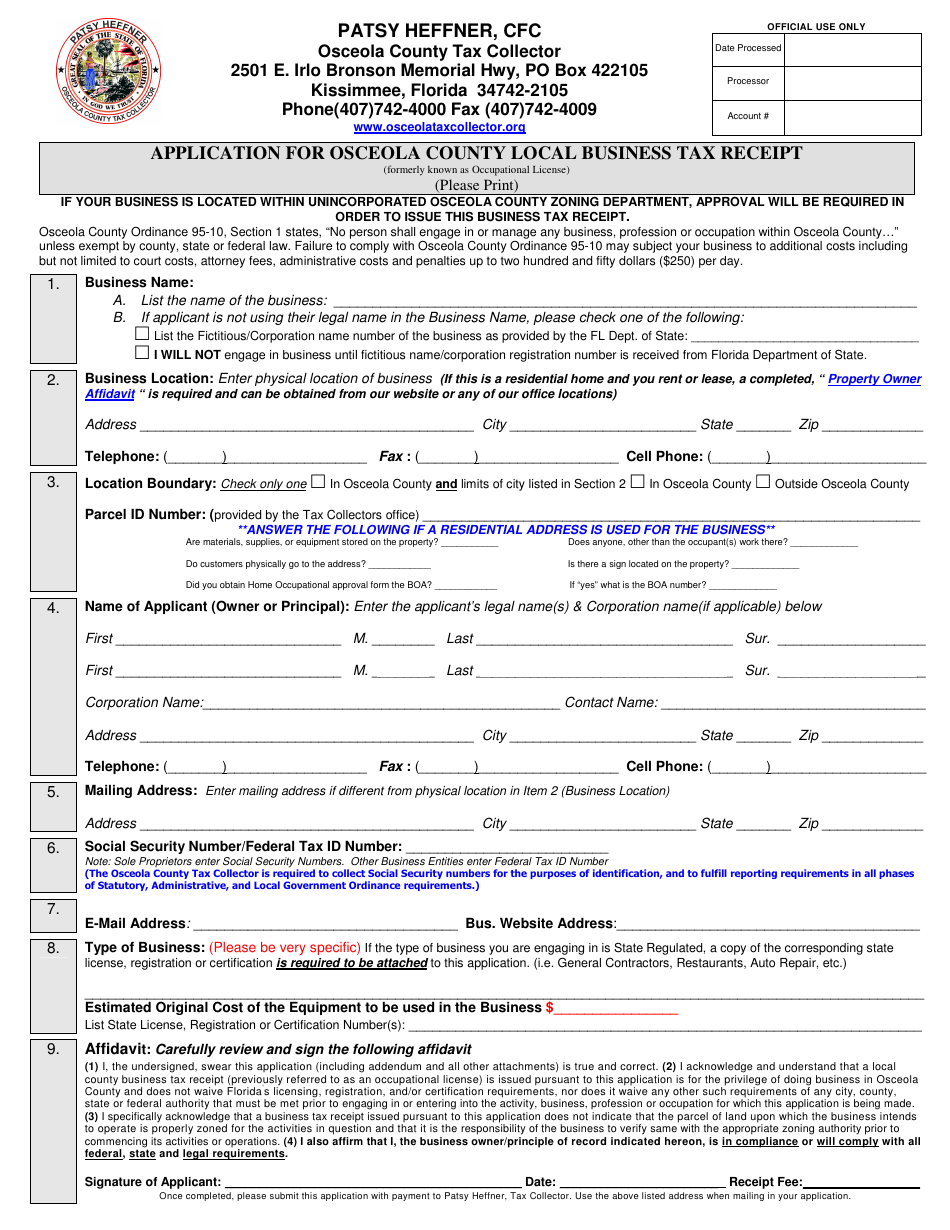

Osceola County Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Osceola County Property Appraiser How To Check Your Property S Value

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden

![]()

Osceola County St Cloud Propose Smaller 2021 22 Budgets Osceola News Gazette

Coronavirus Covid 19 Resident Resources

Osceola County Tax Collector S Office Bruce Vickers Facebook

Osceola County Property Appraiser Open Data

Osceola County Tax Collector Office Of Bruce Vickers Serving Our Citizens With Dignity Respect

Property Tax Search Taxsys Osceola County Tax Collector

Online Payments Osceola County Tax Collector Office Of Bruce Vickers

Osceola County Tax Collector S Office Bruce Vickers Facebook

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden